How to Receive a Wire Transfer

Wire transfers are an efficient and secure way to transfer money from one account to another. They can be used for a variety of purposes, such as sending money to family, paying a business invoice, or making a large purchase. If you’re looking to receive a wire transfer, there are a few steps you’ll need to take in order to ensure the money is deposited safely and quickly.

The first step in receiving a wire transfer is to provide any requested information to the sender. This may include your full account number, the name on your account as it appears on your statement, and the receiving bank’s American Bankers Association (ABA) routing number.

Once you have provided the necessary information to the sender, it’s important to budget for any transfer fees that may be associated with the wire transfer. Fees can vary depending on the type of transfer, whether it’s domestic or international, and can range from a few dollars to several hundred.

It’s also important to find out the estimated delivery time for your wire transfer, as well as how to track it. Most domestic transfers are processed on the same day and international transfers are typically completed within a few days.

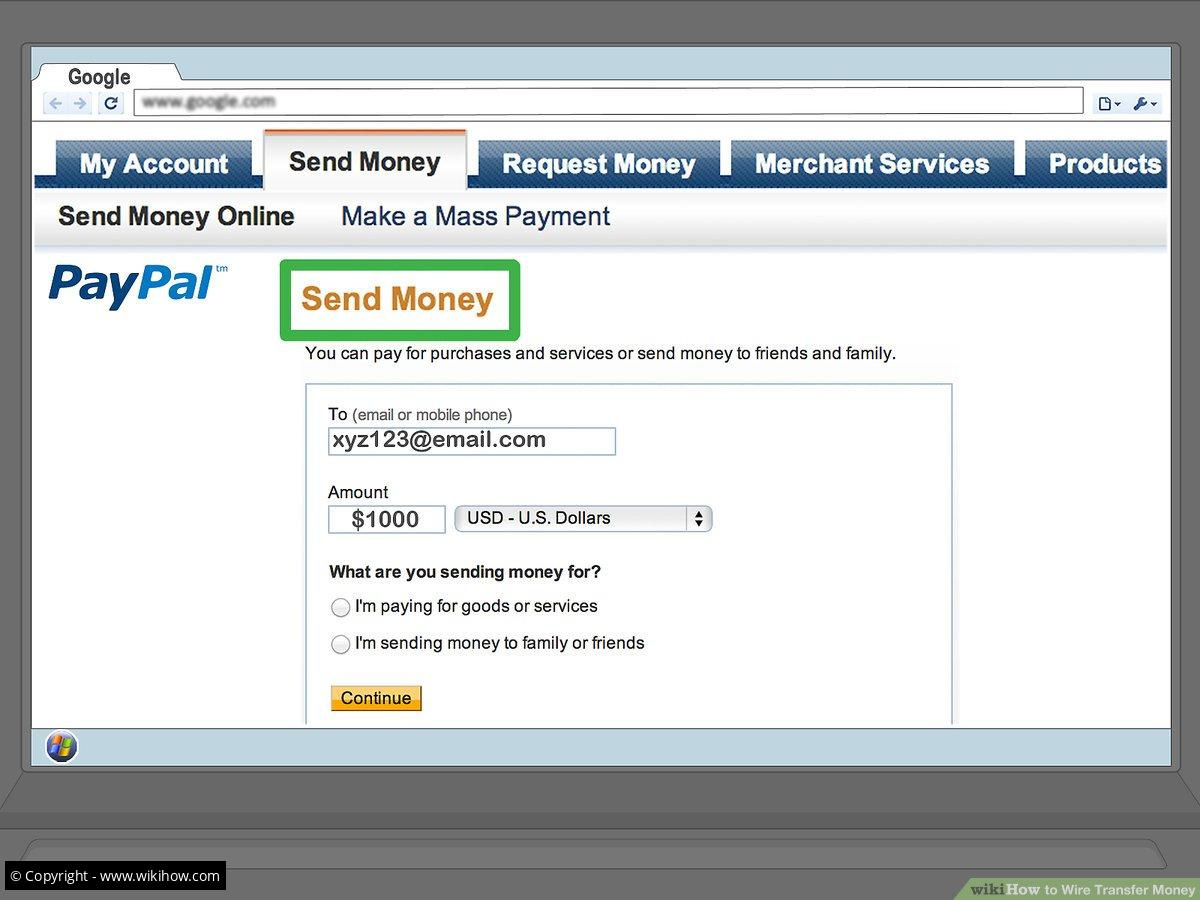

If you need to complete a transfer urgently, you can set up a wire transfer through a bank, in-store provider, or online money transfer specialist. You’ll need to provide the recipient bank name (the bank that the money is going to), the recipient bank’s American Bankers Association (ABA) routing number, and the recipient’s account number.

In most cases, a wire transfer can only be stopped or paused for corrections if a cancellation notice is received before the transfer is complete. To avoid any delays or complications, it’s important to provide accurate information and confirm all details before sending the wire transfer.

Domestic transfers will be deposited and made available the same business day if received by 5 p.m. ET. International wires may take 3–5 business days to arrive. The wire will be received by the recipient’s bank the same day, if requested by 2 pm ET Monday-Friday (except Federal holidays). If it’s requested after this time, it may take an additional business day for the transfer to be completed.

By following these steps, you can ensure that your wire transfer is received quickly and securely.

To receive a wire transfer, what information is required?

7

Proof of identity.

Does money sent via wire transfer get deposited directly into your bank account?

A wire transfer is a way of sending money electronically from one bank account to another. The banks act as the intermediaries, with the sender’s bank first sending the funds to the recipient’s bank and finally to the recipient.

What is the process for sending or receiving a wire transfer?

The sending bank transmits a message with payment details via a secure system, like Fedwire or SWIFT, to the recipient’s bank. The recipient’s bank then obtains all the required information from the initiating bank and deposits its own funds into the appropriate account.

Is it secure to get money through a wire transfer?