How to Manage Discount Rate

Discount rate is a key tool of monetary policy used in banking and corporate finance to determine present value of future cash flows. Understanding and effectively managing the discount rate is essential for businesses to maximize return on investments. This article will explain how to calculate the discount rate and provide some tips on how to manage it.

Step 1: Calculate the Present Value

The first step in calculating the discount rate is to divide the future value (FV) of a cash flow by the present value (PV). In this example, the FV is $16,000 and the PV is $10,000. Therefore, the discount rate (r) is (16,000 / 10,000) or 1.6.

Step 2: Determine the Discount Rate Formulas

Once the discount rate is calculated, it is important to determine which formula to use when managing the discount rate. The two most common formulas are the weighted average cost of capital (WACC) and the adjusted present value (APV) formula. The WACC formula is: WACC = E / V x Ce + D / V x Cd x (1 – T), where E stands for the cost of equity, V stands for the value of the firm, Ce stands for the cost of capital, D stands for the cost of debt, Cd stands for the debt interest rate, and T stands for the tax rate.

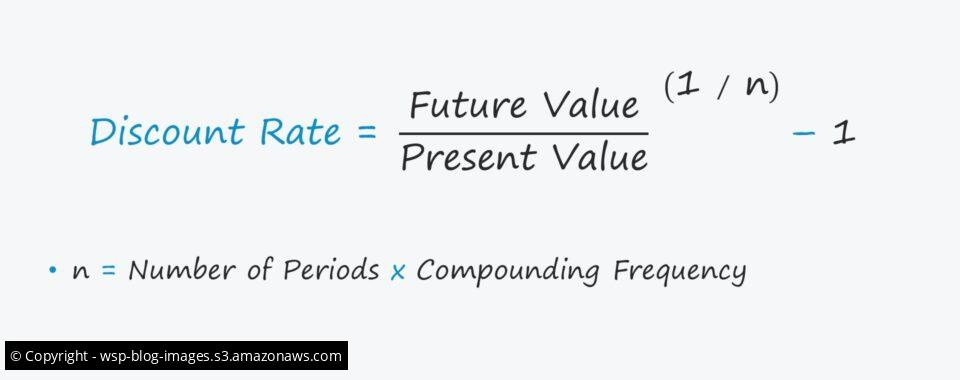

Step 3: Calculate the Discount Rate

The discount rate is the rate of return used in a discounted cash flow analysis to determine the present value of future cash flows. To calculate the discount rate, the company’s future cash flows need to be determined using the company’s net present value. This can be done by blending the cost of a company’s debt and equity based on the company’s capital structure. Additionally, the discount rate can be calculated by taking the covariance of the historical return of the company’s stock and the market divided by the variance of the market.

Step 4: Tips to Manage the Discount Rate

Once the discount rate is determined, there are several tips to help manage it. First, it is important to keep track of the company’s cash flows and ensure that the discount rate remains in line with the company’s present value over time. Additionally, businesses should review their capital structure regularly to ensure the discount rate is correctly calculated based on the company’s debt and equity costs. Finally, businesses should consider using the WACC and APV formulas to help manage the discount rate more effectively.

In conclusion, managing the discount rate is an essential part of maximizing return on investments. By following the steps outlined in this article, businesses can ensure they are accurately calculating and effectively managing their discount rate.

.

What is the procedure for establishing a discounted rate?

Both of these

formulas involve calculating the cost of equity (E), the cost of debt (D), the

value of equity (V), the value of debt (V), the corporate tax rate (T), and the

market risk premium (Ce).

What is the procedure for dealing with discount rate issues?

To calculate a discount, one needs to take the original cost of the item and multiply it by the decimal representation of the percentage rate. The sale price is then determined by subtracting the discount from the original price.

What is a favorable rate of reduction?

A business valuation may typically use an equity discount rate range of 12% to 20%.

What factors do businesses use to determine the amount of a discount?

The most common way to calculate the discount rate is by using a weighted average cost of capital (WACC) method. This method takes the after-tax cost of debt and the cost of equity and combines them based on the company’s target debt-equity ratio, which is determined by the current market conditions.

.